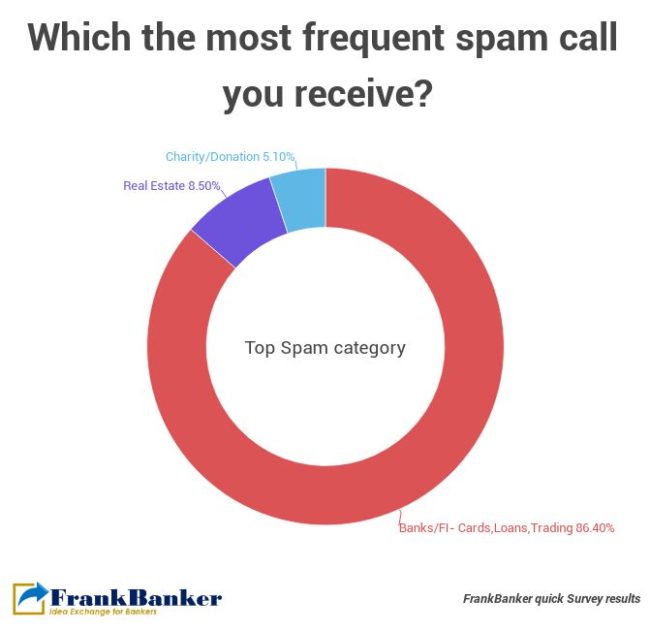

In a recent survey we found 86% of participants reported Banks and FIs to be the biggest spammers. A further quick dipstick revealed anywhere between 5 spam calls on a peaceful day to 20 on a disturbing day. And we are not even talking about spam SMS, Emails and more recently, unwanted Whatsapp promotions.

National Do Not Call (NDNC) seems ineffective. Call blocking apps do help but come at the cost of data privacy and unwanted ads.

Despite our efforts to avoid such calls, the scale and consistency at which these persist, indicates these callers must be tasting some success. This is how the maths for selling loans through tele cold calling works

-Bank needs, say, 500 new customers a day

-With people blocking or not answering the calls, the call pick up rate may be < 10%

-The overall conversion rate of loans may be a dismal 1-2% of the calls answered

-This is a 5 Lakhs calls per day!

-And that’s just the personal loan division of one bank! Add more for Credit Cards, Car Loans, Home loans and Savings Accounts

-Assuming only top 20 Banks and NBFCs are doing this aggressively, we still have 1 cr (10 Mn) calls originating from financial services alone, per day

While the numbers are guesstimates, we may still be underestimating the spam menace! As more and more banks, NBFCs compete aggressively and chase that much elusive growth, phase 2 of the spam era may just be around the corner.

With costs of communication coming close to zero, there is little disincentive for the ‘harasser’ to stop. The large scale and repeated ‘loan repayment reminder’ SMS from a new age NBFC, even to their non-customers, is a recent case in point of the level of harassment this has reached. Many of us wondered ‘Why is my number in that NBFC’s database?’

Centralised efforts like NDNC that address the problem across sectors, seem to have met with limited success and the menace has only grown with Banks and FIS contributing significantly to it.

A better approach may be for RBI to take cognizance and put brakes on this incessant customer harassment. Some large penalties may be good starting point. But a more sustainable approach could be a creating a centralized database where,

-the customer has direct access for easily activating/deactivating bank-wise marketing calls (can be derived from NDNC)

-customers can file complaints against repeat harassers

-Automated penalties can be levied. Firstly, by regularly releasing the data of top spammers (based on number of complaints). Secondly, using the complaint data to impose financial penalty/customer compensation for continued harassment

In the meantime, Banks need to realise that every interaction with customers, existing or potential, is a moment of truth. Pestering only leads to increased trust deficit as the customer starts to see an ‘aggressive marketer’ and not a ‘trusted partner’.

Author Profile Disclaimer: The opinions expressed here are those of the author and does not reflect the views of FrankBanker.com

Amit Balooni is the Founder of FrankBanker. In his 20 years banking and consulting career, he has worked with leading banks and now advises banks globally on SME, SCF, Credit Risk and Strategy. Through his workshops, he has trained more than 2500 bankers across mid and senior levels. And continues his learning while pursuing a PhD in banking.

Amit Balooni is the Founder of FrankBanker. In his 20 years banking and consulting career, he has worked with leading banks and now advises banks globally on SME, SCF, Credit Risk and Strategy. Through his workshops, he has trained more than 2500 bankers across mid and senior levels. And continues his learning while pursuing a PhD in banking.