In Part 1 we warmed up and discussed the limitation of conventional definitions of liquidity and limitations of Current Ratio. We now expand our learning and move towards a comprehensive Liquidity Assessment Framework.

This ‘liquidity assessment framework’ for credit risk, broadly comprises of 3 key aspects

- Current Ratio (discussed in Part 1)

- Net Working Capital

- Cash-flow velocity

We discuss the second aspect in this article.

Net Working Capital

A predictable operating cycle is a necessary condition to plan for adequate liquidity. Once we are reasonably sure of the Debtor cycle, Inventory holding and Creditor days, it is easy to infer and match inflows with outflows.

However, while a company can plan for liquidity based on this cycle, business does not necessarily work with so much predictability. Inadvertent and uncontrollable events cannot be ruled out. What happens if the otherwise liquid receivables, get delayed? Or the otherwise fast-moving Inventory moves at a pace much slower than expected?

Larger question- How will the company pay-off current liabilities in such cases?

It is impossible for any credit analyst to analyse all the existing debtors and inventory movements while simultaneously future gazing behaviour changes or predicting events.

Furthermore, there is another risk that has historically been a reasonable worry for the analyst- the tendency of borrowers to use immediately available short term cash inflows for an impending or urgent capex. Keeping aside our judgement of it being good, bad, ugly, unavoidable or deliberate, it necessarily impacts liquidity of the company.

In essence, even after we have taken due care of matching correctly graded current assets to current liabilities, the business eventualities, customer behaviour and business exigencies may still bring new challenges. How does a lender factor in these potential risks on company’s liquidity?

The answer is simple- keep a buffer. Net Working Capital (NWC) is what provides that buffer.

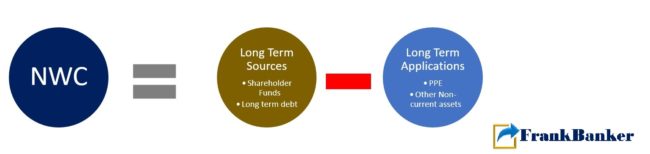

NWC is the excess of Long-term Sources (LTS) of funds over Long-term Application (LTA) and is the amount available for building current assets. While it is well known concept, I advise on keeping three considerations in mind while analysing NWC.

Firstly, the underlying principle of NWC is to increase Promoter’s contribution towards current asset creation. However, since we consider long-term sources in toto, in some cases the contribution from long term debt may be much higher than shareholders’ funds. Thus, the need to exercise due caution, even when NWC appears to be adequate.

Secondly, NWC is not a silo

A 20-25% NWC is generally considered a good buffer as per the regulatory guidance (Ref: Turnover method -Nayak Committee and Maximum Permissible Bank Finance or MPBF- Tandon Committee). This can be supported empirically as well by analysing robustness of lending portfolios. However, NWC needs to be closely read in tandem with Current Ratio. For example, while using MPBF, the required NWC of 25% also means the Current Ratio should be 1.33. And, if we are benchmarking NWC at 20%, the Current Ratio should be 1.25.

Asset bankers, both on Business and Credit side, should necessarily analyse and comment on the movement of both NWC and CR in tandem when looking at liquidity especially while funding for working capital.

Third consideration from credit risk perspective is about judging and accepting NWC shortfall. While ‘how much shortfall is acceptable?’ may not have a straight answer, there is still a logic to ‘whether such shortfall is acceptable?’. There could be many factors including bank’s risk appetite, market conditions, regulatory stipulations etc that may affect a bank’s decision, the following example will give you some direction towards a more objective method that can be used in many cases.

Primetech Ltd has an actual NWC of 20% against the bank’s policy benchmark of 25%. This was due to the company using its own funds for some immediate machinery replacement that was needed at year end. Other factors being adequate, Bank may accept this considering, a. past NWC has been within threshold and b. profit margins are high enough to bridge this 5% gap within the 12-18 months.

But the problem of NWC shortfall isn’t always so simple or event driven. In many cases such shortfalls may be regular. Does that make the case bad? Does it mean we should avoid such borrowers? Do such borrowers always face liquidity crunch?

Not necessarily. We will explore these aspects in Part 3.

Author Profile

Amit Balooni is the Founder of FrankBanker. In his 20 years banking and consulting career, he has worked with leading banks and now advises banks globally on SME, SCF, Credit Risk and Strategy. Through his workshops, he has trained more than 2500 bankers across mid and senior levels. And continues his learning while pursuing a PhD in banking.

Amit Balooni is the Founder of FrankBanker. In his 20 years banking and consulting career, he has worked with leading banks and now advises banks globally on SME, SCF, Credit Risk and Strategy. Through his workshops, he has trained more than 2500 bankers across mid and senior levels. And continues his learning while pursuing a PhD in banking.

Disclaimer: The opinions expressed here are those of the author and does not reflect the views of FrankBanker.com