Accelerating Financial Recovery: Leveraging ODR in the Banking Sector

By aligning Online Dispute Resolution processes with the principles outlined by the RBI, Banks and financial institutions can navigate disputes efficiently, reduce recovery time, and bolster customer trust.

Banking Frauds in India: A look at Data and its revelations

Frauds have been Bank’s Achilles heel for time immemorial. FY20 saw a astonishing 160% rise in the reported frauds over previous year. This is despite the increased regulatory oversight, use of technology and increasing digitisation of data. But seems the fraudsters move one step ahead of the system. But there are some twists in the tale. In this storyboard we looked at the reported data for Indian Banks, deep dived and found some interesting observations.

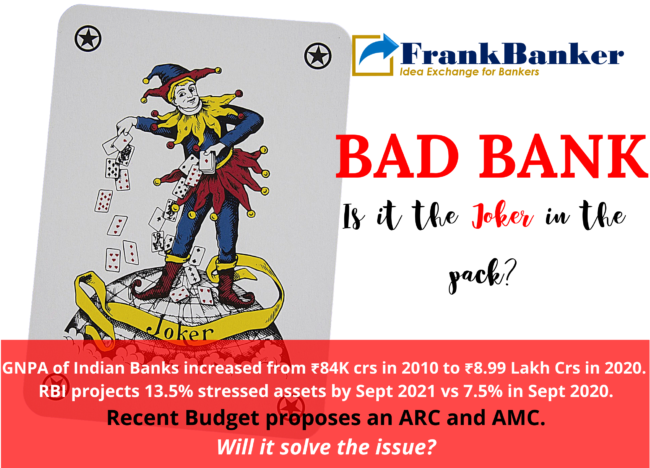

BAD BANK: Is it the Joker in the pack?

GNPA of Indian Banks increased from ₹84K crs in 2010 to ₹8.99 Lakh Crs in 2020. RBI projects 13.5% stressed assets by Sept 2021 vs 7.5% in Sept 2020. Recent Budget proposes a Bad Bank ARC and AMC to handle this.

What is it and whether it can be a game changer in the stress portfolio game? We analyse and inform through this storyboard

Total Bank Assets and NPA -India

In this data storyboard we take a quick look at Loans and Advances of Indian Banks and compare them to the growing Gross and Net Non-Performing Assets ( GNPA and Net NPA)