Selling Products isn’t banking.

Customisation is a fairly common feature for services. But Banks, unfortunately, seem to be stuck in a time warp of ‘Terms and Conditions’, with an unalterable ‘product feature’ list and complex ‘warranty’ terms!

It’s ironic that while the product companies, from automobiles to electronics, talked about customer experience, banks seemingly regressed to 20th century product sales methodologies – ‘customer can have it painted any colour, as long as it is black’.

Henry Ford’s belief of “as long as it is black’’ may have been apt for his time when mass production was the new-found business strategy. It was efficient to run large factories on standardised product configurations. Customisation meant higher downtime and increased costs.

Maybe, banks needed similar standardisation in their back-offices for efficient processing. One reason for adopting such an approach was increasing demand from banks to be transaction facilitators. But, beware! It is easy to confuse transaction facilitation as banking. It isn’t.

Banks neatly stacked their products on a shelf – Saving accounts, Current Accounts, Forex cards, Credit Cards etc. Standard offerings and variants with standard features, just like a readymade suit. ‘Suit yourself. Sometimes it may fit’. They adopted a ‘Product’ mindset.

Notefully, banking is much more nuanced and intangible than tailoring a suit. In matters of money, foundations of relationship cannot be transactional alone. Just like taking measurements cannot be considered as tailoring, handling transaction is only about money movement. It would be erroneous to judge the craftsmanship, unless its delivered, tailored to your fit.

Another interesting dimension to note is that, in product selling, Sales and Service are separated. Every time your car gets an issue you don’t take it to the Car salesmen but to the Service Station. Unfortunately, banks seemed to have adopted similar model for Banking services. For most, Phone Banking seems to be the go-to service point while your RM seems helpless.

This product mentality has led banks to build aggressive sales culture. A bothersome Car Salesman and pestering Bank RM, appear to be no different. Banks prioritise spends on Sales teams over Customer service, with larger budgets for recruitment, retention and training. Best resources are placed in ‘front end’, a synonym for sales. Post-sales customer ‘handling’ is ‘Service’ team’s job, sadly, with a menial connotation. And yes, re-designating Sales Managers as Relationship Managers doesn’t solve the problem.

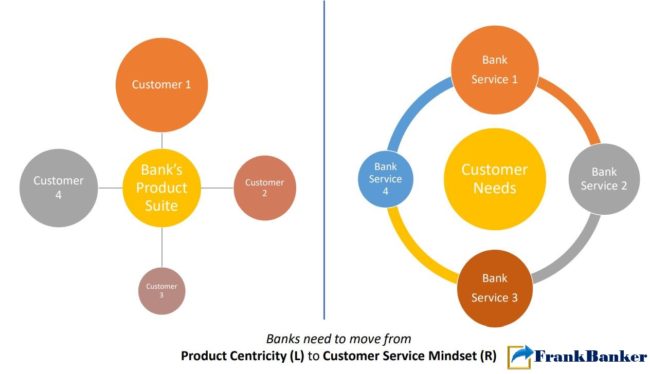

This product mindset is reflected in their measurement of success by “How many products sold?” instead of “How well are the customers serviced?”

Bespoke. Universal. What customer needs.

The key role of a banker is money management and advisory. The classical definition of taking deposits and providing loans is their raison d’être. Handling transactions is only a knock-on effect. Offering transaction facilitation, in a standard pack with balance maintenance, isn’t banking. Not until a bank has understood and customised it to the requirements of the customer. Each customer. But in reality today, it’s the customer who is adjusting to Bank products, processes, documentation, cut-off timings and branch hours.

It may be moot whether this standardisation improves efficiency but it does bring rigidity in both servicing and providing solutions.

While it is given that any large structure would need guidelines to stay course, the absolute neglect of customisation, absence of advisory to customers at large and absence of customer centricity are the bane of banking. With the technology available, how difficult it is to provide, say, truly custom accounts to the customer?

Does that mean banks shouldn’t pursue commercial objectives? They should, absolutely. However, the key differentiator in service industry cannot be a big shelf of OTC products or a large FOS team. Especially so, if the whole relationship is based on building trust. It requires a service mindset- deeper customer understanding, endeavour to provide better service fit and orientation to deliver solutions at the moment of truth.

In the long run, it’s the service mindset that will create winners. Its all the more relevant in times when routine standardisations are increasingly being handled aptly by new age technologies. As the world moves away from handling cash and payments become commoditised, it’s the service and advisory that will differentiate banks.

Even a ‘good’ bank may get it all wrong if it relies on customer appreciation for faster transaction processing instead of evaluating if customers are indeed getting right advice from its employees. The premise of building retail as well as commercial banking only on TAT and Product features is flawed. It should be built on bespoke offering and sound advisory that is easily accessible to smallest of customers and not only on fast cheque clearing!

Its time banks stopped behaving like an assembly line. And well, I haven’t even talked about cross-sell.

COMMENTS