There are two key aspects of Retail Banking. First its high-volume game and requires scale. Second, since the products are fairly well established, makes it easy for Sales teams to map the needs. Customer possibly already knows much about the product. What requires deliberation and effort is –how should Sales teams differentiate their bank from the competition?

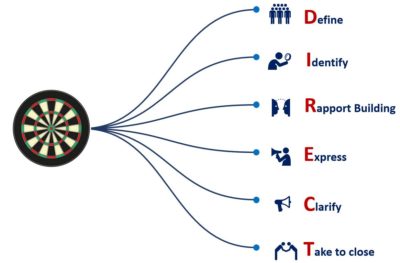

With short sales cycles, low product differentiation and high competition it is critical that the Retail Banking teams follow a well thought out plan to bring method to madness. I call this the ‘DIRECT’ Approach to Retail Banking Sales.

Define your ideal customer. What is their age bracket? What their income range? What type of house they live in – apartment, independent house, villa, penthouse etc.? Where do they shop – high street, fashion street? What is their typical banking related problem that your product or service can solve?

Identify them. From where can you find them? Associations, social media channels, other banking channels, third parties? List down the source of the lead and then connect with your prospects through these channels.

Rapport building: Find a common ground to start a conversation. Is it their college, or their native place, or something you saw on their social media or you know someone common? Always talk in terms their interest. Do not jump into selling about your product immediately. Make them like you first.

Express yourself. Present your best foot forward. Look your best, talk what’s relevant, follow business etiquette whether you are face to face or virtual. Listen more and listen to understand the customer’s emotions. Don’t just search for an opportunity to pitch your product. Let them understand why they should choose you over others. And let that not be about your products

Clarify queries. Anticipate the objections and answer them already during your product presentation. Be genuine with what you know and what you can serve. The easiest way to lose your funnel is through false commitments or mis-selling. You do not have to agree with the customer’s objection but acknowledge every objection. i.e. don’t say “I agree with what you are saying”. Say instead “I understand what you are saying”

Take them to close with sincerity. Do not make the customer fill up pages after pages. But do make the customer understand what’s written on these pages. Bankers have seen numerous instances of customer’s complaints because they did not go through the fine prints. Show them your genuine helpfulness. Educate them with the entire post sale process. Nothing should come as a surprise or a shocker to the customer, later.

DIRECT is just a simple yet effective reminder to retail bankers to continuously broaden the top of the Sales Funnel and develop an emotional connect with the customer.

The approach to fill the funnel has to be strategic, with a regular downpour and not just drips. Segmenting customers and preparation helps to target and prospect easily.

But beyond this, most sales teams are so driven by targets that they usually overlook the importance of following the right process. In Retail Banking, this process calls for quick and decisive moves. A lot of discipline on the salesperson’s side and a great deal of smartness at the manager’s end to DIRECT them to sustainable business.

Happy selling!

Author Profile

Pritha Dubey is a seasoned banker and has worked with leading Banks in India. She is currently the Founder of Success Vitamin, Sales and leadership coaching venture and an Official member of Forbes Coaches Council. She received Best Sales Coach award at the World Coaching Congress.

Pritha Dubey is a seasoned banker and has worked with leading Banks in India. She is currently the Founder of Success Vitamin, Sales and leadership coaching venture and an Official member of Forbes Coaches Council. She received Best Sales Coach award at the World Coaching Congress.

Disclaimer: The opinions expressed here are those of the author and does not reflect the views of FrankBanker.com

COMMENTS