Customer engagement seems to be buzzword in every industry nowadays. However, it takes a lot of effort to figure out what customer engagement means for an organisation and a particular industry. Banking industry faces a similar challenge as it gears up to adopt digital solutions for customer engagement.

The modern consumer has high expectations. They want two-way discussion that keeps them engaged online, where they spend maximum chunk of their time in everyday lives.

To put it another way, digital or remote customer engagement is the way forward. To remain step ahead, banks need to have a better view of digital customer experience and understand how it will evolve in the future.

Source: Helplcrunch.com

Before delving deeper , let us first define what digital customer engagement is.

It simply means finding, listening to, and interacting with existing and potential consumers on ongoing basis through various digital channel technologies. Digital customer engagement encompasses any medium or process banks use to communicate with consumers, starting from the very first touch-point. The goal is to provide consumers with something of worth in addition to the normal product and services, to create an emotional bond, loyalty and improve relationship with them.

Every business has two primary objectives i.e. acquiring new and maintaining profitable relations with existing customers. And good customer engagement strategy will help them achieving both objectives among different categories of customers . Banking is a service industry. Hence, it is critical for banks to create credibility and trust among customers through well planned, continuous, and effective customer engagement strategies.

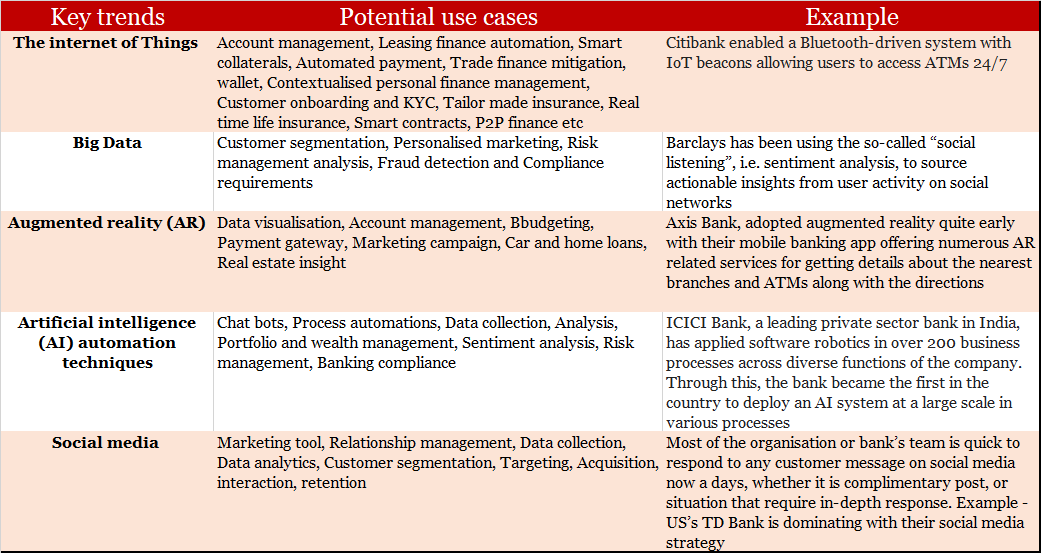

Keeping in mind digital customer engagement space is quickly evolving and increasing, here are few key trends in this space with some examples of Banks already experimenting with the available tools

These trends can be used by banks or any business to take advantage and achieve optimal digital customer engagement strategy.

According to Bottomline Research, while discussing goal of customer engagement initiatives, most of the financial organisations have uniform desire to serve their customers. However, when asked whether they had the tools to effectively engage clients, smaller organisations said their ability to monitor customer engagement, growth opportunities and tools to proactively engage clients are weak as compared to competition. While this requires upgradation of customer engagement solution but not only about technology, but the way technology is being used.

Some of the below mentioned best practices can help banks of all sizes to to get it right:

- Conversational Engagement means interacting with customer through non-human interface for two-way communication and encourage for sharing, reactions, and comments. It focuses on connecting with customers via messaging or voice channels in near real-time. They are more like “conversations” than communications.

Garanti bank’s mobile banking app that talks with customers and OCBC bank’s AI powered voice banking allow customer to start conversation through google assistance are few examples using conversation banking.

- Omnichannel Approach

Omnichannel is about making the same set of services to customers seamlessly across all the channels, both digital and offline. It takes advantage of technology and huge amount of customer data to create superior customer experience. Based on smart data collection-synchronisation-data analytics, bank can develop a 720-degree customer view to provide real time and contextual solution to customers with improved turnaround time, customer conversion / retention rate.

India’s HDFC bank uses omni channel for personalised and orchestrated marketing campaigns. This enables customers to view the same communication across all digital channels – website, email, SMS, whatsapp, paid channels, chatbot Eva, net banking, and mobile app etc. This helps to increase branch recall, purchase consideration and effective business growth.

- Personalisation & Segmentation

It is about using digital channel and data to proactively reach out to your customers with information that is valuable to them. It will also show them that your bank or company remembers the previous interaction you had with them. This can be done by analysing & segmenting customer through demographic & location-based information, customer’s insights, behavioural and psychological triggers.

WealthSimple an online investment service company, Key bank, CITI Bank and CapitalOne are few brands using personalisation strategies to reach out their customer basis demographic, geo, behavioural and psychological data insight from their customers respectively.

- Real time Customer Support

Meet customer expectation by helping customers with their problems at the actual time they occur and not hours or days later. The best options for real time support are mobile messaging, chat bot support, live chat, social media, self-service, experience agents etc.

Live chat option from American Express in India, Erica chat bot by Bank of America and digital only banking from Simple are perfect example of such real time customer service.

- Leveraging Customer Engagement Platform

Using different digital channel is one thing but monitoring customer data from different channel is very important. To deliver the greatest experience, organisation should be aware of all communications customers have with your brand, what product, or services they avail, or how they prefer to be reached out. This will enhance bank or organisation’s ability to gather customer behaviour analytics and identify customer needs and sentiment throughout their entire experience.

- Track Customer Engagement Metrics

Measuring the customer’s’ view of the brand is an essential component in developing a digital customer engagement. This insight will provide critical information on whether the product or service resonates with customers. These can be tracked through metrics like retention ration, active users, core users’ action etc

Author Profile

Chirag Shah is seasoned professional with more than 17 years experience in Operation, Credit, Compliance & Process Excellence functions with Bank & NBFCs. He has worked with leading organisations like ICICI Bank, Tata Capital, Avanse Finance and currently serving as Deputy Vice President at Baroda Global Shared Services Ltd ( Bank of Baroda subsidiary ). He keenly follows trends in technology and finance space. The view expressed are personal and not of the organization he works for.

Chirag Shah is seasoned professional with more than 17 years experience in Operation, Credit, Compliance & Process Excellence functions with Bank & NBFCs. He has worked with leading organisations like ICICI Bank, Tata Capital, Avanse Finance and currently serving as Deputy Vice President at Baroda Global Shared Services Ltd ( Bank of Baroda subsidiary ). He keenly follows trends in technology and finance space. The view expressed are personal and not of the organization he works for.

Disclaimer: The opinions expressed here are those of the author and does not reflect the views of FrankBanker.com