Impact on Supply chains

The pandemic has wrought havoc on supply chains across the world. Be it global or domestic and in an unprecedented scale. It is not that supply chains have not been disrupted before but the sheer pervasiveness and all round disruptions across multi tiers that have been unprecedented.

Over time, Industries had configured their supply chain in keeping with their changes in manufacturing dynamics from vertically integrated manufacturing to horizontally integrated vertically layered manufacturing. The focus was on outsourcing components and assemblies with strict control on inventory carrying cost. Just in time, lean inventory management had been the order. Going forward, this order is likely to be severely tested and disrupted with a shift more towards responsiveness rather than the predominant focus on efficiency.

To complicate matters, introduction of technology in manufactured products/ manufacturing and distribution processes have brought a different sets of complexities to the fore.

To cite and example – data reveals that a conventional IC engine driven entry level car requires USD 330 (INR 25000) worth of semiconductors. The figure is anywhere between USD 1000 to US 3500 (INR 75000 to 260000) for higher end / hybrid vehicles. It would be much higher in Electric Vehicles which need more complex battery management and drive control systems. In other words the traditional cost and risk management structures need to be taken a complete relook.

Digitization has also impacted supplier-buyer relationships and bargaining powers / buyer-seller leverage. For vendors, however, despite small size, it has meant access to larger markets and market places. Vendor-buyer relationships, both at the commercial and the technological level, need to be reconfigured if competitive advantages are to be built and sustained through future disruptions which could be more frequent than before as we move out of this pandemic. Even the smallest vendor at the nth tier upstream would demand and deserve a new level of respect.

All this arises from the fact that disruption can happen at any layer in the supply chain and can catastrophically impact the OEMs ability to deliver the final output to the market, threatening their very sustainability and survival. OEMs will therefore need to digitise their upstream substantially and speed up the process, to be able to be online in understanding the risk/ disruption happening across the supply chain end to end, leaving nothing to chance. It will speed up digitization rapidly , where I believe , Block Chain will drive such linkages because DLT by structure enables greater transparency , reliability and authenticity whilst being cost effective building blocks to ensure tighter control and response. Consequently this will lead to nurturing and building strong partnerships/ capabilities across multiple geographies, rather than focusing on available capabilities in certain geographies. In other words help build technical and financial capabilities to ensure a resilient and effective supply chain.

Emergence of SCF as distinct from other forms of trade finance

Supply Chain Financing (SCF), is a part of the basket of trade finance products that are available to fund global and domestic trade. The tool got a substantial push with the advent of technology to map and monitor transactions which are financed under the open order system to enhance cash flows for SME suppliers upstream. This brought greater working capital efficiencies for the AAA rated corporates whilst improving their responsiveness by passing on substantial stocking requirement to the upstream vendors in order to enable them service the OEMs, under the just-in time inventory mode.

The surplus liquidity in the system over the past years helped in developing this product, anchored by the AAA rated large corporates. The focus lay in leveraging the rating of a large corporate and use the transaction and seller/ buyer power to drive transactional funding into primary Tier 1 suppliers and customers of a corporate supply chain.

For banks and non-banks it meant higher possibility of funding to the anchor AAA rated corporate without burdening the corporate balance sheets. It also helped them go around the credit concentration norms mandated by the regulators

International Chamber of Commerce (ICC) Banking Commission’s trade register confirmed that the bouquet of products that comprise trade finance exhibited low risks versus other asset classes. This helped in popularising supply chain financing as a product. In 2018, ICC started sharing the data for SCF as a distinct trade finance product to reflect the shift from documentary trade towards open account terms. The ICC report stated that the probability of default for Supply Chain Finance is comparable to other short term trade finance products.

It may also be pertinent to point out that SCF, if undertaken with appropriate checks in terms of clear supply and trade in movement of goods and services, reflects real economic activities characterised by shorter maturities (hence lower tenure risk) and will take a shorter time to recover post the pandemic than other asset classes while delivering better business volumes.

Way forward for SCF practitioners

Supply Chain Financing rules have been eased by RBI to permit NBFCs to participate in reverse factoring platforms which are anchored around PSUs and top rated corporates.

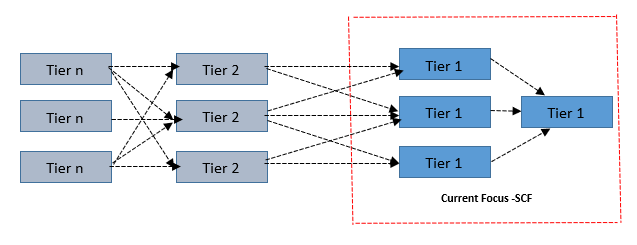

Most of the fintech platforms in Supply Chain Financing remain critically dependent on-boarding AAA rated / PSUs anchors to help them pay their immediate vendors. This ignores the fact that many of the supply chains have multiple tiers beyond, without which the immediate vendor would not be able to sustain, if other parts of the supply chain fail, due to liquidity issues or for that matter any other supply disruptions up stream.

Most of the supply chains in an Industry be it Auto, FMCG, Consumer Durables or in Defence are multi-layered/tiered supply chains. These are key strategic drivers to lower costs, reduce capital assets and get products to market more efficiently than the competition. However multi-tier strategies increase complexities and reduce the visibility of many critical links in the supply chains which can disrupt an entire production process, as the pandemic related disruptions have devastatingly demonstrated.

Corporates will have to increasingly use technology to get a complete visibility of their multi-layered supply chains in order to control and manage future risks. This, I believe, will be a major digital transformation based supply chain risk management exercise going forward.

The expected changes are likely to make the role of Supply Chain Finance practitioners more complex and demanding, whilst at the same time more exciting, attractive and specialized in the future

At present, all the fintech /receivables discounting platforms e.g. Invoicemart, M1Exchange, RXIL are all independent platforms operating in silos. They cater to the same set of clients namely AAA rated corporates and their vendors who sell the invoices duly accepted by their on boarded customers on the platforms. The buyers of invoices under discount mode being banks and NBFCs looking at MSME financing which are done based on the acceptance of the well rated borrowers. The comfort is derived from anchor corporates who are expected to pay on the due dates (mostly). In many sense it is an indirect form of leverage of the primary anchor. All these platforms do not provide visibility of the supply chain beyond the immediate tier whereas most chains remain multi-tiered. Risk in any of the tier or layer may endanger the final output in terms of quality of delivery / ability to deliver/ sustainability leading to financial defaults across the supply. The representative diagram below visualizes the scenario.

With supply chains getting transformed across industries the need of supply chain finance practitioners to adapt to the changing times to bridge the USD 300 Billion credit gap will be increasingly felt and demanded, to add value and understanding to the financial process.

The time is ripe for fintechs to build special skills in addressing multiple tiers of a supply chain across various Industry domains depending on their domain understanding /specialization and the risk / return appetite/ expectation to address the Nth tiers of a layer of a supply chain. Technology, of course, will remain critical value and risk mitigation driver to enable clarity and transparency on flow of material and liquidity across different tiers. Special skills in categorizing SKUs in terms of their supply chain risks will present challenges and of course tremendous opportunities. There are multiple models already available for categorising SKUs across Industries.

These, in my opinion, will drive the following benefits

- Increase liquidity funding to the MSME sector to push their contribution to GDP from 30% to 50% given that the immediate addressable supply chain finance market in India is around Rs 60000 crores.

- Enhance liquidity and availability of transaction secured, short term credit to the MSME sector with no need for additional collaterals.

- Permit smaller anchors to tie up with their vendors for supply chain financing given that there is complete view of the flow of material and liquidity across the supply chain.

- Enable fintechs derive better valuation and attain competitive edge for future viability and sustainability.

- Increase banking/ NBFC reach through partnered SCF with risk sharing possibilities.

- Replicate the model for the OEM downstream partners and in the process support the entire supply chain, end to end.

- Help corporate OEMs deal with the emerging supplier buyer relationships better

Author Profile

Sanjoy Banerjee is an industry veteran with a career spanning 39 years across Financial Services, IT and Engineering Industry. He has held leadership positions with with marquee corporates including L&T, SRF Finance and ICRA. In his entrepreneur avatar he established Seriata Information Systems in 2000. He is currently a consultant and trainer with leading agencies including CRISIL and IFC. Sanjoy has deep domain expertise in Mortgage and MSME lending and has advised and trained across many organisations during last decade.

Sanjoy Banerjee is an industry veteran with a career spanning 39 years across Financial Services, IT and Engineering Industry. He has held leadership positions with with marquee corporates including L&T, SRF Finance and ICRA. In his entrepreneur avatar he established Seriata Information Systems in 2000. He is currently a consultant and trainer with leading agencies including CRISIL and IFC. Sanjoy has deep domain expertise in Mortgage and MSME lending and has advised and trained across many organisations during last decade.

Disclaimer: The opinions expressed here are those of the author and does not reflect the views of FrankBanker.com