Category: Banking Operations

Accelerating Financial Recovery: Leveraging ODR in the Banking Sector

By aligning Online Dispute Resolution processes with the principles outlined by the RBI, Banks and financial institutions can navigate disputes effici [...]

Decriminalisation of Cheque Bounces : Pros and Cons

In order to improve ease of doing business in India, Ministry of Finance issued a notification inviting suggestions on decriminalisation of around 39 [...]

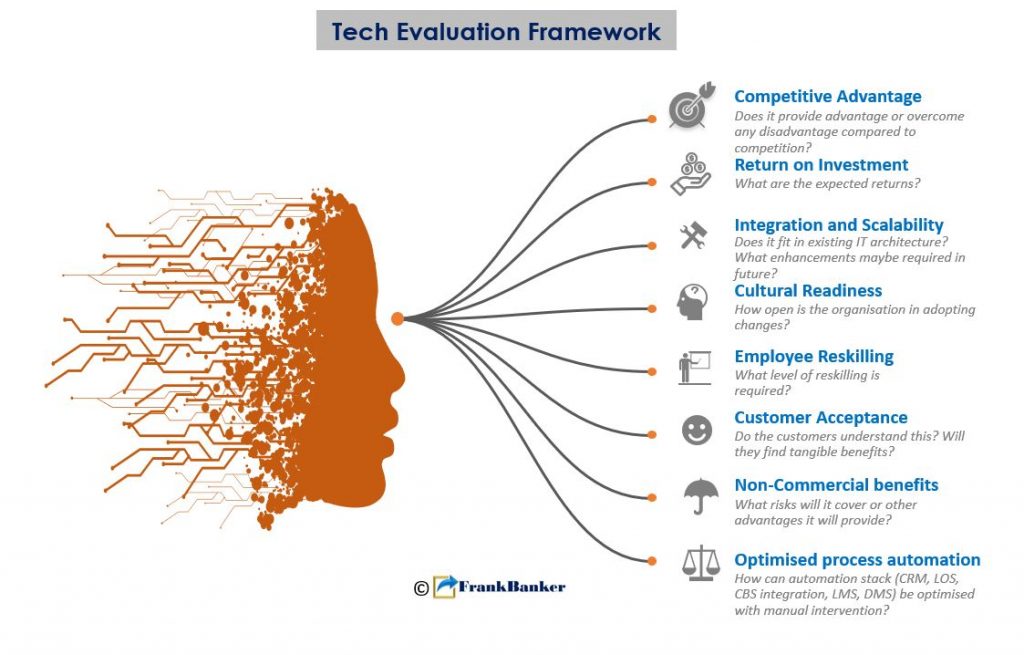

Is Technology the panacea? (SME Lending Models 3)

Technology has benefits. It can improve TAT, data access, accountability, reduce operational risk & build competitive advantage. Full workflow [...]

Machine Learning and AML

World is a not flat!

No matter how much the globalisation theorists may want you to believe, the world post 9/11 is no longer flat but rather becomea [...]

How Artificial Intelligence will transform Banking

Artificial Intelligence can simplify banking- relieve the pain of redundant forms, cumbersome documents and slow processes and even manage investment [...]

5 / 5 POSTS