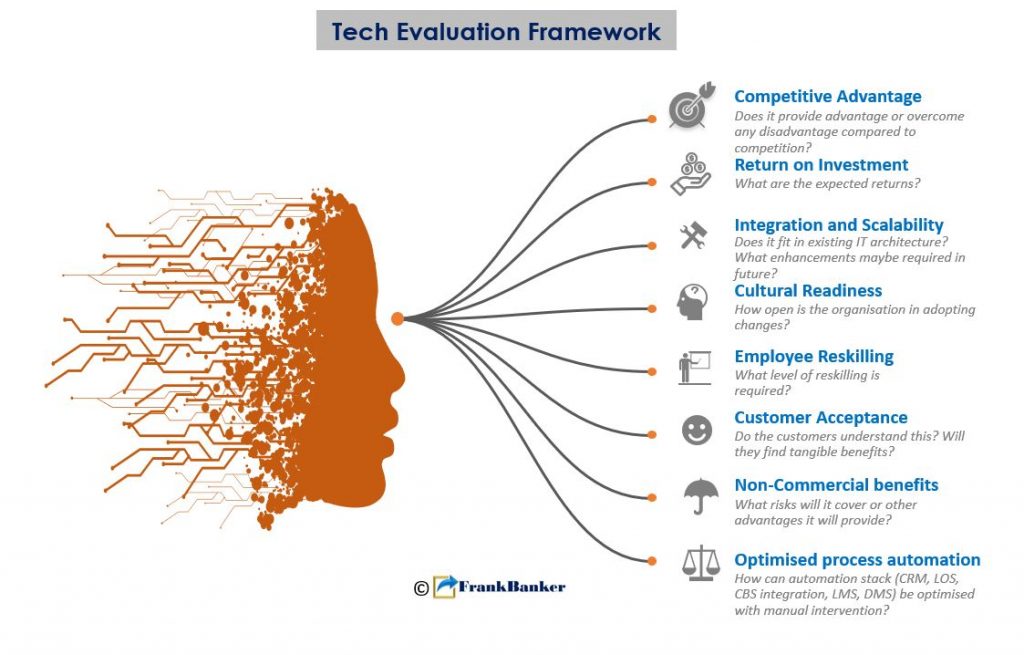

Technology has benefits. It can improve TAT, data access, accountability, reduce operational risk & build competitive advantage. Full workflow digitisation suite- Tabs +CRM+LOS+CBS integration+ LMS+DMS, seems impressive. “Let’s get it automated” is an oft repeated indulgence we hear during our engagements. But the devil is in details!

Considering investment in any scalable tech is high and returns trickle in slowly, we have a case for considering tech optimisation. In lending workflow, extent of digitisation is a function of business maturity, tangible gains & payoffs and not of fancy market trends. Deferring non-critical tech and balancing with manual interventions may well provide an optimal process mix & save cash for tactical sustenance.

Another key consideration is external & internal customer readiness. If target customer isn’t tech savvy, your LOS linked online origination may be redundant! Internally, cost of reskilling, integration downtime & cultural barriers, are make or break factors. Tech cannot offset poor acquisition or #CreditRisk analysis skills.

Tech is not a panacea but only means to an end.

To what end: Fast approval or profitable business? More loans or more tech?

COMMENTS